We compare prices by looking at Standing Charges and the cost per kWh from each supplier. Standing charges are daily fixed costs that cover things such as maintenance, manual meter readings and keeping your property connected to an energy network. The cost per kWh is for per unit of energy used.

You can in most cases, however it is important to note that a supplier is not obligated to provide you with an energy supply and they can reject contracts due to your credit rating, supply size or their own criteria.

In order for us to find you the best deal we typically need a recent bill, your business’s registration information, your MPAN/MPRN numbers and the end date of your current contract. You will be able to find most of this information on a bill or you can request it from your current supplier.

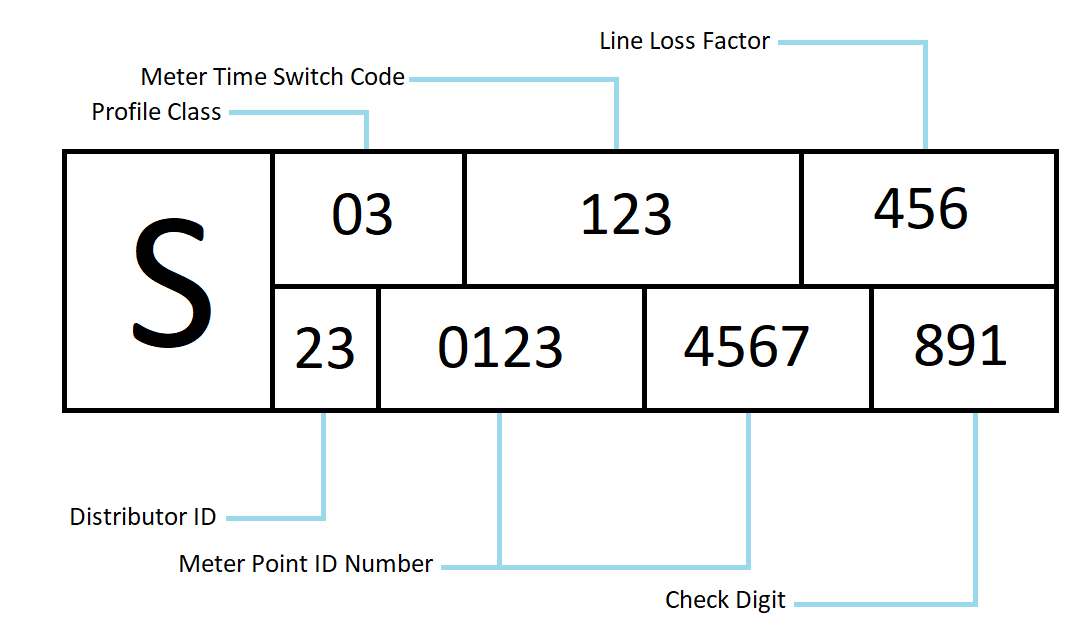

The number will start with an ‘S’ and is usually printed on a bill. Below is an example of what your MPAN will look like. You will find this printed on your electricity bill.

Your MPRN for gas can be found on your gas bill under the supply details section and will show as a series of up to 10digits. See below example.

Gas meter point reference: 5094211379

Half-hourly meters provide more accurate information by providing electronic meter reads every 30 minutes. Half hourly meters are typically used by large/high energy users with a demand higher than 100kW. You can see whether you are a half hourly customer by checking the top line of your MPAN and to see if it starts 00. You will find this on a copy of your bill under supply details. You can also tell as there will be a communications link so the meter can be read remotely daily. We have allocated account managers that specialise with dealing with Half Hourly meters for our clients.

If you have just taken over a property you will be supplied by the same supplier (incumbent)as the previous occupier. Often they will charge you “out of contract” rates which are normally higher. You should always check and arrange a new supply contract shortly after moving in to ensure you are on the best rate for you and your business.

As mentioned above, “out of contract” rates are usually the highest and you will often find them if you’re a business new to a property or if you have terminated a contract but not switched it over to a new supplier. Suppliers usually require 28 days’ notice to switch on to another rate.

No, Forward Energy UK Ltd will arrange this for you. Working on your behalf with a customers signed letter of authority we are able to send your old supplier a termination letter making it even simpler to switch.

We do not charge our clients directly for using our services. We receive industry set commission from the energy suppliers we work with who ensure we provide fair comparisons.

VAT on energy for businesses is normally charged at 20%. However, some businesses meet the ‘De Minimis’ requirements and then would be billed at 5%. This means using an average of no more than 33 kwh per day (1,000 kwh per month) for business electricity and/or less than an average of 5 therms or 145 kwh per day (150 therms or 4,397 kwh per month) for business gas. If a business falls within this criteria they will only attract the 5% VAT on gas and electricity bills.

Climate Change Levy (CCL) is an environmental tax applied to your commercial energy usage designed to encourage businesses to be more energy efficient.

The proportion of any bills charged at 5% VAT are exempt from CCL.

Large businesses could also be partially exempt from CCL if they hold a Climate Change Agreement (CCA). This is a voluntary arrangement made by UK Industry and The Environment Agency to reduce energy use and CO2 emissions. The CCL will be reduced by 90% on electricity bills and 65% on other fuels. To find out your eligibility please visit the HMRC website. If you do meet the criteria then a PP10 and PP11 will need to be completed and sent to the supplier.

An LOA (Letter of Authority) is a document signed by our client which allows Forward Energy to act on their behalf when liaising with suppliers. This does not allow Forward Energy to sign contracts on behalf of our clients. It is worth noting that not all brokers adopt this approach

The Climate Change Levy (CCL) is a Government tax, which came in to place in 2001, for the use of both gas and electric by businesses, agriculture and the public sector. The aim of the levy is to encourage industry, commerce and the public sector to improve energy efficiency and reduce greenhouse emissions.

| Taxable commodity | Rate from 1 April 2020 | Rate from 1 April 2021 | Rate from 1 April 2022 | Rate from 1 April 2023 |

| Electricity (£ per kilowatt hour (KWh)) | 0.00811 | 0.00775 | 0.00775 | 0.00775 |

| Natural gas (£ per KWh) | 0.00406 | 0.00465 | 0.00568 | 0.00672 |

| LPG (£ per kilogram (kg)) | 0.02175 | 0.02175 | 0.02175 | 0.02175 |

| Any other taxable commodity (£ per kg) | 0.03174 | 0.03640 | 0.04449 | 0.05258 |

*Info as per GOV.UK – Climate Change Levy Rates

Residential / domestic buildings – including accommodation for children, the armed forces, care homes, rehab centres, hospices, monasteries & nunneries.

An institution which is the sole or main residence of at least 90% of its residents – except hospitals, prisons or similar institutions, hotels, inns or similar.

Self-catering holiday accommodation, caravans & houseboats. Charitable organisations.

All of the above will qualify for a reduced rate of VAT on gas bills and electricity bills.